Overview Page

The overview page will give an overall perception of the performance and prospects of the cryptocurrency market, as well as the leaderboard for assets, which can assist traders in conducting preliminary screening of potential assets.

Fear&Greed Index

It uses a variety of metrics (volatility, market momentum, social media, etc) from different sources to calculate a single score that reflects the overall sentiment of the market. The score ranges from 0 to 100, with a score of 0 indicating extreme fear and a score of 100 indicating extreme greed. The index is measured on a daily, weekly, monthly, and yearly basis. In theory, it can be used to gauge whether the crypto is fairly priced in a larger time frame.

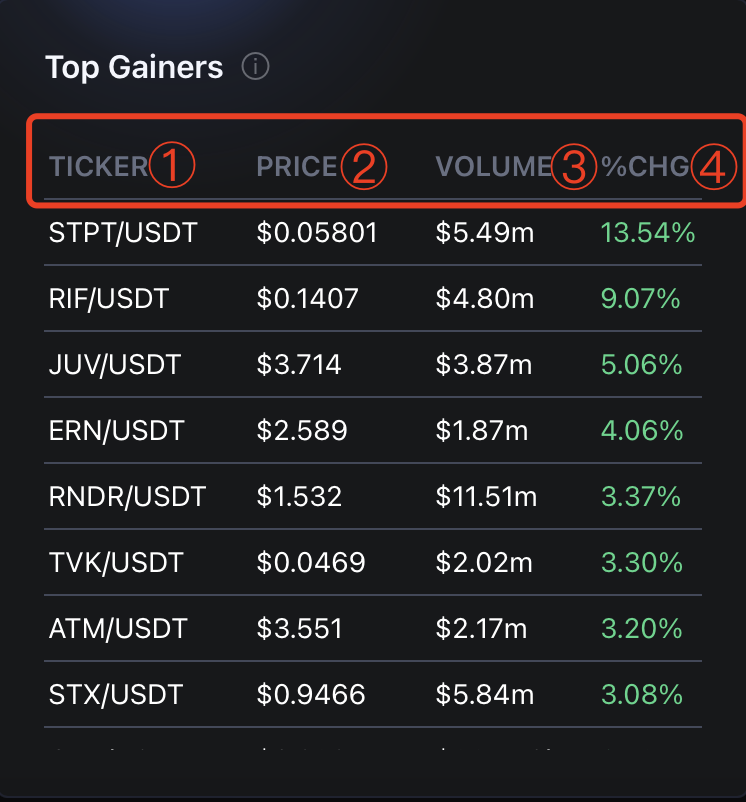

Top Gainers

Cryptocurrencies that have experienced the highest percentage increase in price over a given period of time, typically a day. These cryptocurrencies are often of particular interest to investors and traders because they may represent an opportunity for significant profits in a short amount of time. This table discovers digital assets that have been the largest percentage gains in price starting 0:00 (UTC+00:00).

①TICKER: The name of a currency pair. (ex. BTC/USDT, APE/USDT, etc)

②PRICE: Current USD value of the underlying asset.

③VOLUME: The cumulative trading volume starting 00:00:00(UTC+0).

④%CHG: Comparison between the current price and the price at 00:00:00(UTC+0) on the same day.

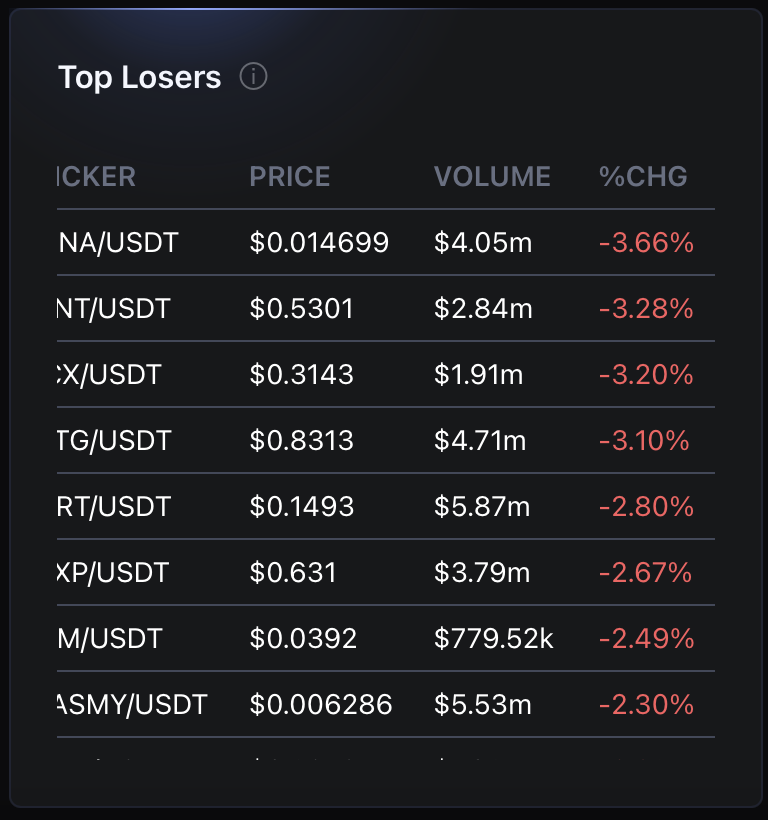

Top Losers

This table is the opposite to "Top Gainers", which discovers digital assets that have seen the biggest declines starting at 00:00:00(UTC+0) every 24hrs.

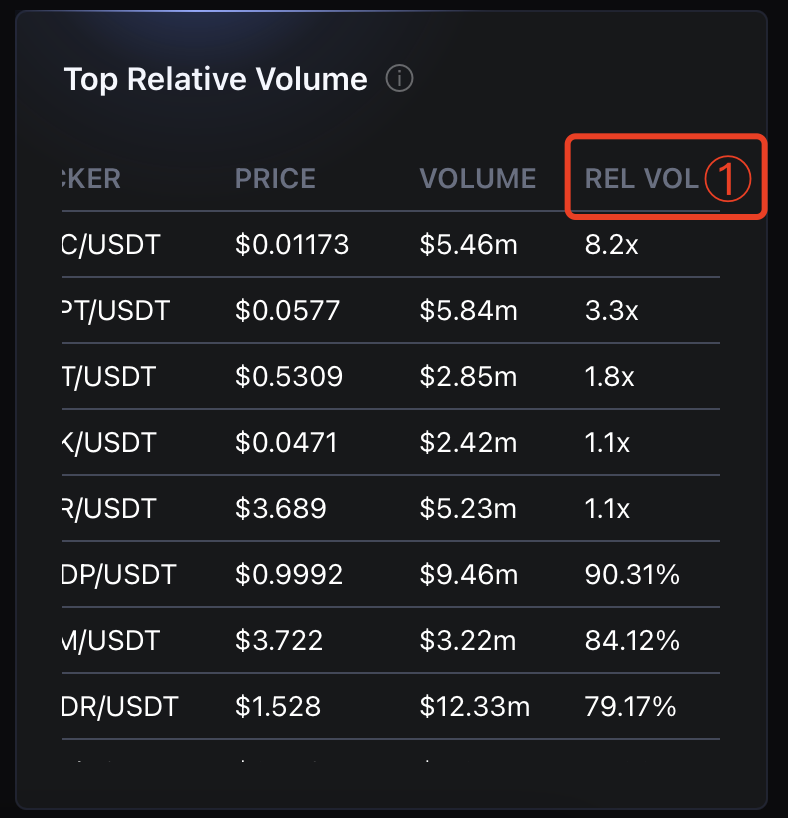

Top Relative Volume

Top relative volume refers to a situation where the current volume of trading activity for a particular asset is significantly higher than its average volume over a specified period of time. This can be an indication of increased interest and participation in the market for that asset, which in turn may suggest that there is significant buying or selling pressure on the asset.

①REL VOL: The Relative Change Percentage (REL VOL) is calculated by the accumulative volume of the current day divided by the average daily trading volume of the past period of time.

Daily Market Tide

This live chart mainly shows the accumulative premium of BTC & ETH option trades and the BTC price for the past 24h. If both lines are close to each other, then the bullish and bearish sentiment is roughly equivalent. If the two lines are not trending in parallel, it indicates that the sentiment is becoming increasingly bullish or bearish.

Note:

- Bullish Sentiment (Option Tide): The call premium is rising more rapidly or the put premium is declining more rapidly.

- Bearish Sentiment (Option Tide): The call premium is declining more rapidly or the put premium is rising more rapidly.